You may have a Will, but that’s no guarantee your wishes will be carried out.

Confused about the differences between a Will and a Trust? If so, you are not alone. While it is always wise to contact Estate Planning experts like us, it is also important to understand the basics. Here is a quick and simple reference guide:

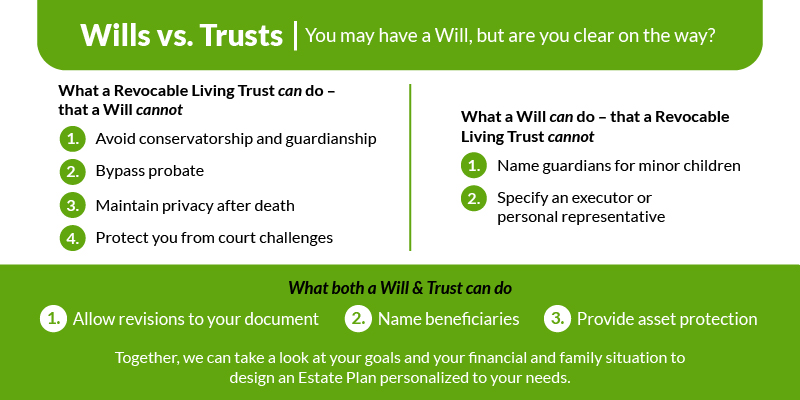

What a Revocable Living Trust can do – that a Will cannot

A Revocable Living Trust is one of the best ways to keep your assets out of probate and make sure they are distributed the way you intended.

1. Avoid conservatorship and guardianship: A Revocable Living Trust allows you to name your spouse, partner, child, or other trusted person to manage your money and property that has been properly transferred to the Trust, should you become unable to manage your own affairs. A Will only becomes effective when you die, so a Will is useless in avoiding conservatorship and guardianship proceedings during your life.

2. Bypass probate: Accounts and property in a Revocable Living Trust do not go through probate to be delivered to their intended recipient. Accounts and property that pass using a Will guarantees probate. The probate process, designed to wrap up a person’s affairs after satisfying outstanding debts, is public and can be costly and time-consuming — sometimes taking years to resolve.

3. Maintain privacy after death: A Will is a public document; a Trust is not. Anyone, including nosey neighbors, predators, and the unscrupulous can discover what you owned and who is receiving the items if you have a Will. A Trust allows you to maintain your loved ones’ privacy after death.

4. Protect you from court challenges: Although court challenges to Wills and Trusts occur, attacking a Trust is generally much harder than attacking a Will because Trust provisions are not made public.

While those capabilities make Trusts an important tool of your Estate Plan, Trusts only protect the assets in them. There are things a Will can do that a Trust cannot.

What a Will can do – that a Revocable Living Trust cannot

A Will allows you to determine how your estate is handled after you’re gone. That includes important roles that need to be filled.

1. Name guardians for minor children: A Will – not a Living Trust – can be used to name guardians to care for a minor child. Depending on the law in your state, there may be an additional document that can be used to name a guardian; however, a Revocable Trust is not that document.

2. Specify an executor or personal representative: A Will allows you to name an executor or personal representative – someone who will take responsibility to wrap up your affairs after you die. This typically involves working with the probate court, gathering and protecting your accounts and property not owned by a Trust, paying your debts, and giving what remains to your named beneficiaries. But, if there are no accounts or property in your individual name (because you have a fully funded Revocable Trust), this feature is not necessarily useful.

These are important roles, so make sure you have a Will in place, even if you distribute your assets through another legal vehicle.

What both a Will & Trust can do

There are also a few powers that both a Will and Trust can exercise, but they may do so in different ways. Such as these:

1. Allow revisions to your document: Both a Will and Revocable Living Trust can be revised whenever your intentions or circumstances change, so long as you have the mental ability to understand the changes you are making.

*There is such a thing as Irrevocable Trusts, which cannot be changed without legal action. These are outside the scope of this discussion.

2. Name beneficiaries: Both a Will and Trust are vehicles that allow you to name who you want to receive your accounts and property.

- A Will simply describes the accounts and property and states who gets what. Only accounts and property in your individual name will be controlled by a Will. If an account or piece of property has a beneficiary, pay-on-death, or transfer-on-death designation, this will trump whatever is listed in your Will.

- While a Trust acts similarly, you must go one step further and “transfer” the property into the Trust – commonly referred to as “funding.” This is accomplished by changing the ownership of your accounts and property from your name individually to the name of the Trust. Only accounts and property in the name of your Trust will be controlled by the Trust.

3. Provide asset protection: A Trust and, less commonly, a Will, are crafted to include protective Sub-Trusts that can allow your beneficiaries to receive some enjoyment and benefit from the accounts and property in the Trust. These keep the accounts and property from being seized by your beneficiaries’ creditors, such as divorcing spouses, car accident litigants, bankruptcy trustees, and business failures.

While some of the differences between a Will and Trust are subtle, others are not. Together, we will take a look at your goals as well as your financial and family situation to design an Estate Plan personalized to your needs.

Our mission at eLegacy is to empower individuals to create their legacies by delivering comprehensive, personalized Estate Plans, all in a convenient and easy-to-understand process. Call us today to schedule your virtual consultation and let’s get started.